Table of Contents Show

I. Introduction

The Rise of Online Trading Systems

In recent years, there has been a significant rise in the popularity of online trading systems. With advancements in technology and internet connectivity, investors now have the opportunity to access financial markets from the comfort of their own homes. Gone are the days when trading was limited to the floors of stock exchanges. Now, anyone with an internet connection and a computer or mobile device can participate in the global financial markets.

Online trading systems provide individuals with the ability to buy and sell various financial instruments, including stocks, bonds, commodities, and currencies, through electronic platforms. These platforms connect investors with brokerage firms, allowing them to execute trades in real-time. The availability of online trading systems has democratized the financial markets, making it more accessible to a wider range of individuals.

Benefits of Online Trading Platforms

Online trading platforms offer a range of benefits that have contributed to their popularity:

1. Convenience: One of the primary advantages of online trading systems is convenience. Investors can access the markets at any time, day or night, from anywhere in the world. This flexibility allows individuals to trade according to their schedule and eliminates the need for physical visits to brokerage offices.

2. Cost Savings: Online trading platforms often have lower commission fees compared to traditional brokerage firms. Additionally, investors can save on travel expenses and other associated costs. This cost-effectiveness makes online trading systems an attractive option for both casual and active traders.

3. Quick and Efficient Execution: Online trading systems enable traders to execute trades instantly. With just a few clicks, investors can buy or sell financial instruments, taking advantage of market opportunities as they arise. The efficiency of online trading platforms ensures that traders can act swiftly and capitalize on favorable market conditions.

4. Access to Information: Online trading platforms provide investors with access to a wealth of market data and research tools. Traders can perform technical and fundamental analysis, access real-time quotes, and utilize charting tools to make informed investment decisions. The availability of information empowers individuals to conduct thorough research and stay updated on market trends.

5. Education and Support: Many online trading platforms offer educational resources and support to help individuals navigate the intricacies of the financial markets. Online tutorials, webinars, and demos can provide valuable insights and help traders enhance their knowledge and skills. Additionally, customer support services are usually available to assist users with any queries or issues they may encounter.

6. Diversification and Global Market Access: Online trading platforms offer access to a wide range of financial instruments, allowing investors to diversify their portfolios. With just a few clicks, traders can buy and sell stocks from different markets, invest in foreign currencies, or trade commodities. The global market access provided by online trading systems opens up a world of investment opportunities.

It is important to note that while online trading systems offer numerous benefits, they also come with a certain level of risk. Investors should exercise caution, conduct thorough research, and seek professional advice when necessary. By using online trading platforms responsibly, individuals can take advantage of the opportunities presented by the global financial markets.

II. eToro

eToro Overview

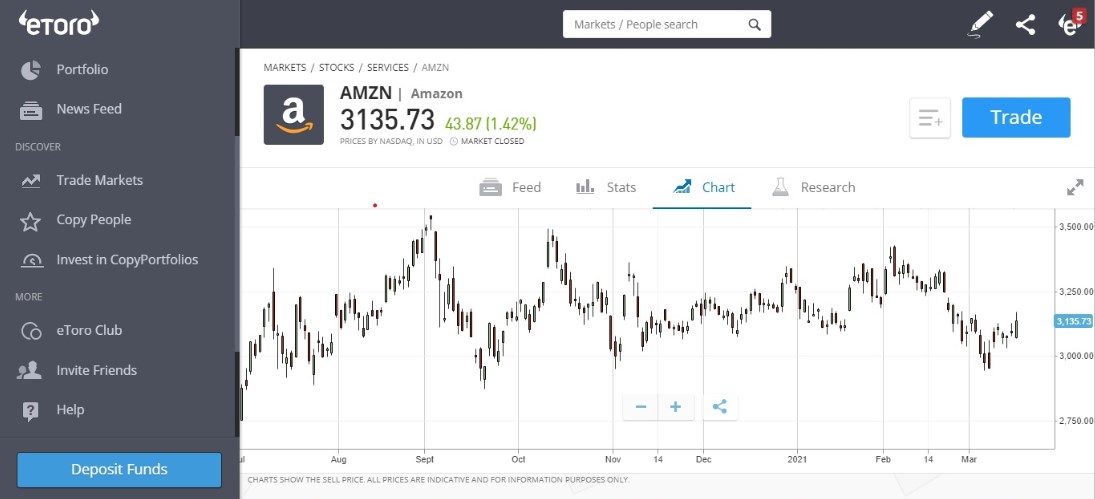

eToro is a leading online trading platform that offers a wide range of financial instruments for trading, including stocks, cryptocurrencies, commodities, and more. With over 20 million registered users worldwide, eToro has gained a reputation for its user-friendly interface and innovative features that make trading accessible to both beginners and experienced traders.

One of the standout features of eToro is its social trading platform, which allows users to connect with and copy the trades of successful traders. This social aspect of trading opens up opportunities for beginners to learn from experienced traders and potentially earn profits by following their strategies.

eToro also prioritizes user security and has implemented strict measures to protect user funds. The platform is regulated by reputable financial authorities, ensuring that it operates in compliance with industry standards.

To learn more about eToro and its features, you can visit their Wikipedia page.

eToro Copy Trading Feature

One of the standout features of eToro is its Copy Trading feature, which allows users to automatically replicate the trades of successful traders on the platform. Here’s how it works:

1. Discover and Follow: Users can browse through a vast selection of traders on eToro and choose to follow the ones that match their investment goals and risk tolerance. Each trader has a profile that displays their trading history and performance metrics, making it easy for users to evaluate their track record.

2. Copy Trades: Once a user chooses to follow a trader, they can allocate a portion of their funds to automatically copy their trades. Whenever the trader executes a trade, it will be replicated in the user’s account proportionally.

3. Control and Customize: eToro’s Copy Trading feature provides users with various customization options. Users can set their own risk management parameters, such as limiting the amount of capital allocated to each copied trade or imposing a maximum stop loss level.

4. Monitor and Adjust: Users have full visibility into the trades executed by the traders they follow. They can monitor the performance of their copied trades in real-time and make adjustments if necessary. They can also choose to stop copying a trader at any time.

The Copy Trading feature on eToro offers a unique opportunity for novice traders to learn from and piggyback on the success of experienced traders. It eliminates the need for in-depth market analysis and allows users to participate in the financial markets even with limited knowledge and experience.

It is important to note that while copying successful traders may increase the chances of earning profits, it does not guarantee profitability. Market conditions and individual strategies can vary, and it’s essential for users to carefully evaluate the traders they choose to follow and perform their own due diligence.

Overall, eToro’s Copy Trading feature provides an innovative and user-friendly way to engage in online trading. It offers a learning opportunity for beginners and can potentially generate profits for users who choose to follow successful traders.

III. TD Ameritrade

TD Ameritrade Overview

TD Ameritrade is a leading online brokerage firm that offers a wide range of investment and trading services. With its user-friendly platform, comprehensive research tools, and extensive educational resources, TD Ameritrade is a top choice for both beginner and experienced traders.

Key features and benefits of TD Ameritrade include:

1. Commission-Free Trading: TD Ameritrade offers commission-free trading on a wide range of stocks, ETFs, and options. This allows traders to execute trades without incurring any additional fees.

2. Robust Trading Platform: The TD Ameritrade thinkorswim platform is highly regarded for its advanced charting tools, real-time data streaming, and customizable layout. Traders can easily access market information, execute trades, and monitor their portfolios all in one place.

3. Extensive Research Tools: TD Ameritrade provides access to a wealth of research and analysis tools to help traders make informed investment decisions. From fundamental analysis to technical indicators, traders can leverage these tools to gain insights and identify trading opportunities.

4. Educational Resources: TD Ameritrade offers an extensive range of educational resources, including webinars, video tutorials, and guides. Traders can enhance their trading knowledge and skills through these educational materials.

5. Customer Support: TD Ameritrade is known for its excellent customer support. Traders can reach out to their support team via phone, email, or live chat for assistance with account-related inquiries or technical issues.

TD Ameritrade Thinkorswim Platform

One of the standout features of TD Ameritrade is its thinkorswim platform. This powerful trading software is highly regarded in the industry and offers a wide range of advanced features and tools.

Some key features of the thinkorswim platform include:

1. Advanced Charting: Traders can access advanced charting tools with numerous technical indicators and drawing tools. These features allow traders to perform in-depth technical analysis and identify potential trading opportunities.

2. Real-Time Data Streaming: The platform provides real-time streaming of market data, including quotes, news, and market depth. Traders can stay updated with the latest market information and make timely trading decisions.

3. Trade Ideas: The platform offers a variety of trade idea-generating tools, including customizable watchlists, screeners, and a strategy roller. These features help traders identify and evaluate potential trading opportunities based on their preferred criteria.

4. Paper Trading: TD Ameritrade’s thinkorswim platform also includes a paper trading feature, allowing traders to practice and test their strategies without risking real money. This feature is particularly helpful for novice traders who are looking to gain experience and confidence before trading with real funds.

5. Mobile Trading: TD Ameritrade provides a mobile app that allows traders to access their accounts and trade on the go. The app offers the same features and functionality as the desktop platform, ensuring a seamless trading experience across devices.

Overall, TD Ameritrade offers a comprehensive online trading system with its thinkorswim platform. With its advanced features, extensive research tools, and educational resources, TD Ameritrade is a top choice for traders looking for a reliable and user-friendly online trading platform.

:max_bytes(150000):strip_icc()/ibkr3-e0bbfb89f38748e8871d5b461047ac2b.jpg)

IV. Interactive Brokers

Interactive Brokers Overview

Interactive Brokers is a highly respected and popular online trading platform that offers a wide range of features and tools for traders. It is known for its low trading fees, extensive product offerings, and advanced trading technology. Whether you are a beginner or an experienced trader, Interactive Brokers has something to offer.

Here are some key benefits of using Interactive Brokers:

1. Low Trading Fees: Interactive Brokers offers some of the lowest trading fees in the industry, making it an attractive option for cost-conscious traders. The platform charges competitive commissions for stock, options, futures, and forex trades.

2. Extensive Product Offerings: Interactive Brokers provides access to a vast range of financial instruments, including stocks, bonds, options, futures, and forex. This allows traders to diversify their portfolios and explore different investment opportunities.

3. Advanced Trading Technology: Interactive Brokers is known for its advanced trading tools and technology. The platform provides traders with access to powerful trading platforms like Trader Workstation (TWS) and Client Portal. These platforms offer a wide range of features, including advanced charting tools, real-time market data, and customizable dashboards.

4. Global Market Access: Interactive Brokers provides traders with access to global markets. The platform allows users to trade in multiple currencies and offers trading on over 125 markets in 31 countries. This international reach allows traders to take advantage of global investment opportunities.

5. Research and Education: Interactive Brokers offers a range of research and educational resources to help traders make informed investment decisions. The platform provides access to market research, analyst ratings, and educational content to help traders stay informed and enhance their trading skills.

Interactive Brokers Advanced Trading Tools

Interactive Brokers offers a wide range of advanced trading tools to help traders analyze the markets, execute trades, and manage their portfolios. Here are some notable features:

1. Trader Workstation (TWS): TWS is Interactive Brokers’ flagship trading platform, offering a comprehensive suite of tools and features. It provides real-time streaming quotes, advanced charting and technical analysis tools, customizable watchlists, and advanced order types. TWS is suitable for both beginner and advanced traders.

2. Client Portal: Client Portal is a web-based trading platform offered by Interactive Brokers. It provides a simplified trading interface, making it ideal for casual traders and investors. Client Portal offers basic trading tools, account management features, and access to market data.

3. mobileTWS: Interactive Brokers’ mobile app, mobileTWS, allows traders to trade on the go. The app is available for iOS and Android devices and provides access to real-time market data, order management, and account information. mobileTWS offers a user-friendly interface and allows traders to monitor their portfolios and execute trades from anywhere.

4. Market Data and Research: Interactive Brokers provides access to a wide range of market data and research tools. Traders can access real-time streaming quotes, news feeds, analyst ratings, and research reports from leading financial institutions. This valuable information helps traders stay informed and make educated trading decisions.

For more information about Interactive Brokers and its advanced trading tools, you can visit their official website: Interactive Brokers Official Website.

Overall, Interactive Brokers is a highly reputable online trading platform that offers a comprehensive range of features and tools for traders. Its low trading fees, extensive product offerings, advanced trading technology, and global market access make it an attractive option for traders of all levels. Whether you are a beginner or an experienced trader, Interactive Brokers can provide the tools and resources you need to succeed in the financial markets.

V. Plus500

Plus500 Overview

Plus500 is a leading online trading platform that offers a wide range of financial instruments for traders to engage in. With its user-friendly interface and extensive features, Plus500 has become a popular choice for both beginners and experienced traders alike.

Key Features:

- Wide Range of Instruments: Plus500 allows traders to access numerous markets, including stocks, commodities, cryptocurrencies, forex, and more. This provides traders with diverse opportunities to explore and diversify their portfolios.

- Intuitive Trading Platform: Plus500 offers a user-friendly and intuitive trading platform that is easy to navigate, even for beginners. The platform is available in multiple languages and provides real-time market data, advanced charting tools, and customizable settings.

- Regulated and Secure: Plus500 is a reliable and trusted broker that is regulated by multiple respected authorities, including the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC). This ensures that traders’ funds are protected and held in segregated accounts.

- Leverage and Risk Management: Plus500 provides traders with the option to trade with leverage, allowing them to amplify their trading positions. However, it is important to note that leverage can increase both profits and losses, so proper risk management is necessary.

- Demo Account: Plus500 offers a demo account that allows traders to practice their trading strategies in a risk-free environment. This is particularly beneficial for beginners who are new to online trading and want to gain experience without risking real money.

For more information about Plus500 and its features, you can visit their official website here.

Plus500 Trading App

Plus500 also provides a user-friendly and convenient mobile trading app for traders who prefer to trade on the go. The trading app is available for both iOS and Android devices and offers a seamless trading experience with the following features:

- Easy Account Management: Traders can easily access and manage their trading accounts, including making deposits and withdrawals, monitoring their trades, and setting alerts.

- Real-time Market Data: The app provides real-time market data, allowing traders to stay updated with the latest price movements and market trends.

- Advanced Order Types: Traders can place various order types, including market orders, limit orders, stop-loss orders, and take-profit orders, to effectively manage their trades.

- Price Alerts: The app allows traders to set price alerts, which can notify them when the price of a specific instrument reaches a certain level. This helps traders stay informed and take advantage of trading opportunities.

- Risk Management Tools: The trading app provides risk management tools, including trailing stops and guaranteed stop orders, to help traders limit their potential losses and protect their profits.

- Demo Mode: Similar to the desktop platform, the trading app also offers a demo mode where traders can practice trading strategies without risking real money.

Overall, Plus500’s mobile trading app is a convenient and powerful tool for traders who prefer to trade on their smartphones or tablets. With its user-friendly interface and comprehensive features, the app allows traders to stay connected to the markets and manage their trades anytime, anywhere.

To learn more about Plus500’s trading app and download it for your device, you can visit the official website here.

V. NinjaTrader

If you’re looking for a powerful and versatile online trading system, NinjaTrader is a popular choice among traders. It offers a wide range of features and tools that can help enhance your trading experience. Here are some key highlights of NinjaTrader:

NinjaTrader features and tools

1. Advanced Charting: NinjaTrader provides advanced charting capabilities, allowing traders to analyze market trends and patterns effectively. The platform offers various chart types, indicators, and drawing tools to customize your charts according to your trading strategy.

2. Market Analysis: NinjaTrader offers comprehensive market analysis tools, including market depth, volume profile, and order flow analytics. These tools can help traders gain insights into market liquidity, trading activity, and potential price levels.

3. Strategy Development: With NinjaTrader’s integrated development environment (IDE), traders can create and backtest their own automated trading strategies. The IDE features a robust programming language called NinjaScript, which allows traders to implement complex trading algorithms.

4. Risk Management: NinjaTrader provides advanced risk management tools, such as simulated stop orders and trailing stops. These tools help traders manage their positions and limit potential losses.

NinjaTrader automated trading

One of the standout features of NinjaTrader is its automated trading capabilities. Traders can develop, test, and deploy automated trading strategies using the platform’s built-in strategy development tools. NinjaTrader supports connection to various brokerage accounts, allowing traders to execute their strategies in real-time.

NinjaTrader also offers a marketplace where traders can find a wide range of third-party add-ons and trading systems. These add-ons can further enhance the functionality of NinjaTrader and provide additional trading opportunities.

To learn more about the features and capabilities of NinjaTrader, you can visit their official website.

In conclusion, NinjaTrader is a powerful online trading system that offers advanced charting, market analysis tools, and the ability to develop and deploy automated trading strategies. It is a comprehensive platform that caters to the needs of both beginner and experienced traders.

VI. Fidelity

Fidelity trading platform

Fidelity is a well-known and trusted name in the world of online trading. Their trading platform offers a wide range of features and tools that make it easy for investors to manage their portfolios effectively. Here are some key highlights of Fidelity’s trading platform:

- Fidelity Active Trader Pro: This advanced trading platform is designed for active traders who require real-time data and advanced trading tools. It offers features such as customizable watchlists, advanced charting tools, and real-time news and research.

- Mobile trading: Fidelity’s mobile app allows investors to trade on the go, with access to their accounts and real-time market data. The app is available for both iOS and Android devices.

- Research and education: Fidelity provides a wealth of research and educational resources to help investors make informed decisions. They offer market insights, analyst research, and educational articles and videos.

- Order types and execution: Fidelity offers a variety of order types, allowing investors to implement different trading strategies. They also offer competitive execution prices.

Fidelity investment options

Fidelity provides a range of investment options for investors to choose from. Here are some of the investment options available through Fidelity:

- Stocks: Investors can trade individual stocks on major stock exchanges.

- Exchange-Traded Funds (ETFs): Fidelity offers a wide selection of ETFs, allowing investors to diversify their portfolios across different asset classes and sectors.

- Mutual Funds: Fidelity offers a large selection of mutual funds, including both actively managed and index funds.

- Options: Investors can trade options contracts on Fidelity’s trading platform, allowing them to implement more complex trading strategies.

- Bonds: Fidelity offers a range of fixed-income investments, including government bonds, corporate bonds, and municipal bonds.

- Retirement accounts: Fidelity provides options for traditional IRAs, Roth IRAs, and 401(k) plans, allowing investors to save for retirement.

With its robust trading platform and diverse investment options, Fidelity is a top choice for online investors. To learn more about Fidelity and its services, you can visit their official website.

VII. Robinhood

Robinhood is a popular online trading platform that is known for its ease of use and commission-free trading. Here are some key features and benefits of using Robinhood:

Robinhood ease of use and commission-free trading

Ease of use: Robinhood is designed with a user-friendly interface, making it easy for both beginner and experienced traders to navigate and execute trades. The platform offers a simple and intuitive layout, allowing users to quickly access their portfolio, trade stocks, and monitor market movements.

Commission-free trading: One of the main advantages of using Robinhood is that it offers commission-free trading. This means that users can buy and sell stocks, options, and cryptocurrencies without paying any trading fees. This can result in significant savings for active traders who make frequent transactions.

Robinhood mobile app

Mobile trading: Robinhood is known for its mobile app, which allows users to trade on the go. The app is available for both iOS and Android devices and offers all the features and functionality of the desktop platform. With the mobile app, users can monitor their investments, place trades, and access real-time market data anytime, anywhere.

Notifications and alerts: The Robinhood mobile app also includes built-in notifications and alerts. Users can set up alerts to receive price notifications for specific stocks or cryptocurrencies, helping them stay informed about market movements and potential trading opportunities.

Robinhood has gained popularity among traders, particularly those who are looking for a user-friendly platform with commission-free trading. With its ease of use and mobile app, Robinhood provides a convenient way for traders to manage their investments and execute trades on the go.

VIII. Charles Schwab

When it comes to online trading systems, Charles Schwab is a well-known and respected name in the industry. They offer a comprehensive range of trading tools and resources, as well as excellent customer satisfaction.

Charles Schwab trading tools and resources

1. Schwab Trading Platform: Charles Schwab offers a powerful and intuitive trading platform that allows users to trade stocks, options, and other investment products easily. The platform provides real-time streaming quotes, advanced charting tools, and customizable layouts.

2. Mobile Trading App: Charles Schwab’s mobile trading app allows users to trade on the go. The app offers a seamless and user-friendly interface, real-time streaming quotes, and access to account information and research tools.

3. Research and Education: Charles Schwab provides extensive research and educational resources to help traders make informed decisions. These resources include market news, analysis, educational articles, and webinars.

4. Investment Tools: Charles Schwab offers a variety of investment tools to help traders manage their portfolios. These tools include portfolio analysis, performance reporting, and risk management tools.

Charles Schwab customer satisfaction

Charles Schwab has a strong track record in terms of customer satisfaction. They are known for their excellent customer service and support, as well as their commitment to providing a seamless trading experience.

According to a survey conducted by J.D. Power, Charles Schwab ranked highest in investor satisfaction with full-service brokerage firms. They received high scores in areas such as account information, investment performance, and customer support.

Overall, Charles Schwab is a top choice for online trading systems, offering a wide range of trading tools and resources, and exceptional customer satisfaction.

IX. Conclusion

When it comes to online trading systems, there are several options available, each with its own strengths and weaknesses. Here is a comparison between some of the top platforms to help you make an informed decision:

MetaTrader 4: Known for its advanced charting capabilities and extensive range of technical indicators. It is widely used by forex traders and offers a user-friendly interface.

eToro: Popular for its social trading feature, which allows users to follow and copy the trades of successful traders. It also offers a wide range of assets to trade and a user-friendly platform.

TD Ameritrade: One of the largest online brokers in the US, it offers a comprehensive trading platform with advanced tools and research resources. It is suitable for both beginner and advanced traders.

Interactive Brokers: Known for its low-cost trading and extensive range of tradable assets. It offers a powerful platform with advanced order types and customizable trading algorithms.

NinjaTrader: Popular among day traders for its advanced charting and analysis tools. It offers a wide range of third-party add-ons and is customizable to suit individual trading strategies.

Fidelity: Known for its research and educational resources, it offers a user-friendly platform with advanced trading tools and a wide range of investment products.

Robinhood: A commission-free trading platform that is popular among young investors. It offers a simple and intuitive interface, making it easy for beginners to start trading.

Charles Schwab: A well-established brokerage firm that offers a comprehensive trading platform with advanced tools and a wide range of investment options.

When choosing an online trading system, it is important to consider the following key factors:

1. User-Friendly Interface: Look for a platform that is easy to navigate and understand, especially if you are a beginner.

2. Range of Tradable Assets: Consider the variety of assets available for trading, including stocks, options, futures, and forex.

3. Research and Analysis Tools: Look for platforms that offer comprehensive research and analysis tools to help you make informed trading decisions.

4. Pricing and Fees: Consider the cost of trading, including commission fees, account maintenance fees, and any other hidden charges.

5. Customer Support: Look for platforms that offer reliable customer support to assist you with any technical issues or questions.

Ultimately, the best online trading system will depend on your individual trading needs and preferences. Take the time to research and compare different platforms to find the one that best suits your requirements.